Complex Options: Butterfly Spreads and Protective Collars

In our previous article on options, we discussed options strategies in depth and explained what a spread is. If you are already familiar with options spreads, we can now look into more advanced options strategies, specifically, butterfly spreads and protective collars.

What is a butterfly spread?

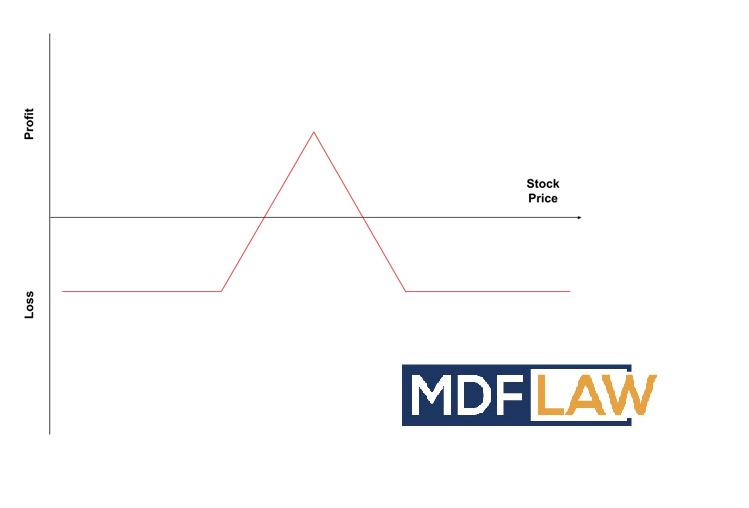

The butterfly spread is thought to take its name from the shape it makes on a P&L graph when one plots the potential gain and loss of the four options contracts used in the butterfly spread.

Butterfly spreads are generally fairly market neutral, using both bull and bear spreads. But even butterfly spreads are influenced by whether an investor feels the stock is going to go up or down.

There are six types of butterfly spreads:

- Long call butterfly spread

- Long put butterfly spread

- Short call butterfly spread

- Short put butterfly spread

- Iron butterfly spread

- Reverse iron butterfly spread

Basics of Butterfly Spread

They all share the same attributes that make them a butterfly spread, which are:

- Four options contracts

- Same expiration date

- Three strike prices (one higher, one lower, and two “at-the-money”)

“At the money” means that a strike price is about the same value as the underlying stock.

The difference between the higher strike price and the at-the-money strike price must be the same as the difference between the lower one and the at-the-money strike price. So, if the at-the-money strike price is $100 and the higher strike price is $120, then the lower strike price must be $80, giving a difference of $20 for each.

Here is a punch-for-punch summary of each of the types of butterfly spreads so you can decide which one to use, depending on whether you’re feeling bullish or bearish on the market.

Long Put Butterfly Spread

Contracts:

- Buy one put at a lower strike price

- Buy one put at a higher strike price

- Sell two at-the-money put contracts

Position at start: Net debt

Strategy for max profit: Stock remains in at-the-money position.

Max possible profit: Higher strike price minus sold put’s strike price, less the premium.

Max loss: Sum of the premiums and commissions.

Short Put Butterfly Spread

Contracts:

- Sell one put at a lower strike price

- Sell one put at a higher strike price

- Buy two at-the-money put contracts

Strategy for max profit: Stock is either above the higher strike price or below the lower strike price.

Max possible profit: Sum of premiums received.

Max loss: Higher strike price minus the strike price of the bought puts, less the premiums received.

Long Call Butterfly Spread

Contracts:

- Buy one call at a lower strike price

- Buy one call at a higher strike price

- Sell two at-the-money call contracts

Position at start: Net debt

Strategy for max profit: When the stock price remains the same as two sold call contracts

Max possible profit: The strike price of the sold call contracts minus the strike price of the lower call, minus the premiums and commissions paid.

Max loss: Sum of the premiums and commissions paid

Short Call Butterfly Spread

Contracts:

- Sell one call at a lower strike price

- Sell one call at a higher strike price

- Buy two at-the-money call contracts

Position at start: Net credit

Strategy for max profit: Stock price is higher than the higher strike price or lower than the lower strike price

Max possible profit: The premium received minus any commission price.

Max loss: The strike price of the purchased call, minus the lower strike, minus the premiums.

Iron Butterfly Spread

The iron butterfly spreads work slightly differently to the previous four butterfly spreads in that they mix puts and calls.

Contracts:

- Buying one put at a lower strike price

- Buying one call at a higher strike price

- Selling one at-the-money put contract

- Selling one at-the-money call option

Position at start: Net credit. Ideal for low volatility situations.

Strategy for max profit: Stock stays at the at-the-money strike price.

Max possible profit: The premiums earned.

Max loss: Strike price of the bought call minus the strike price of the sold call, minus the earned premiums.

Reverse Iron Butterfly Spread

Contracts:

- Selling one put at a lower strike price

- Selling one call at a higher strike price

- Buying one at-the-money put contract

- Buying one at-the-money call option

Position at start: Net debit. Ideal for high volatility situations (the opposite of the Iron Butterfly).

Strategy for max profit: Stock goes above the higher strike price or below the lower one.

Max possible profit: The strike price of the sold call minus the strike price of the bought call, minus the premiums.

Max loss: The premiums paid.

What is the protective collar options strategy?

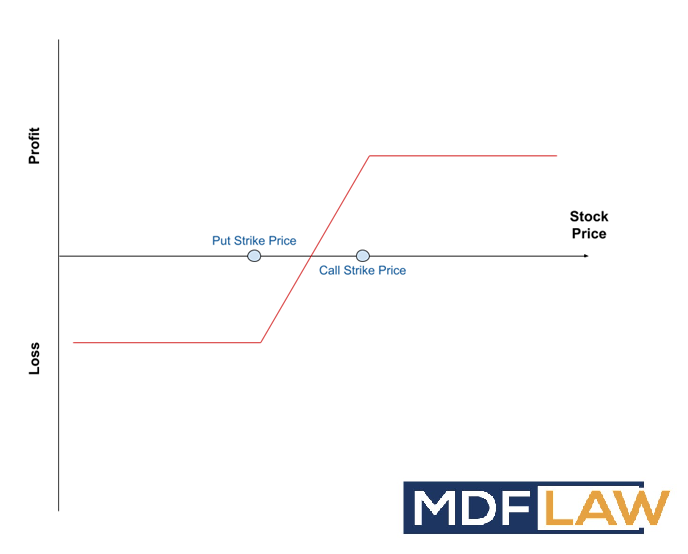

The Protective Collar options strategy is for investors who are long on a stock but feel it might dip, so it offers downside protection. To carry out a Protective Collar, the investor must own the underlying stock.

Contracts:

- Buying a put option at a lower strike price (out of the money)

- Selling a call option at a higher strike price (also out of the money because the seller/writer would be “out of the money” if the underlying stock price spikes and the option is exercised)

- Both contracts have the same expiration date

Basics of Protective Collars

This strategy gives investors some degree of downside protection, the drawback being that they will need to sell their stock at a short call strike. The investor might be fine with this because protective collars are usually created after large gains, so the investor still comes out with a net credit when taking into account their earlier gains. Protective collars are all about risk management and protecting earlier gains from a future slump.

Which options strategy to use?

There are entire college courses on options. Even then, only experience can truly get you familiar enough to know which strategy to use in a particular situation.

Often, investors leave these choices to financial advisors. But it is the duty of the advisor to be completely transparent about the strategy they’re using and why. Even though the subject is complicated, it is the financial advisor’s duty to make it understandable to you, the investor, as part of their responsibilities under FINRA guidelines.