Our attorneys have experience handing negligence and fraud lawsuits against financial advisors and stockbrokers. These claims are generally pursued through arbitration through the Financial Industry Regulatory Authority, or FINRA. Please call 800-767-8040 to speak with an attorney.

Common Types of Disputes Against Financial Advisors

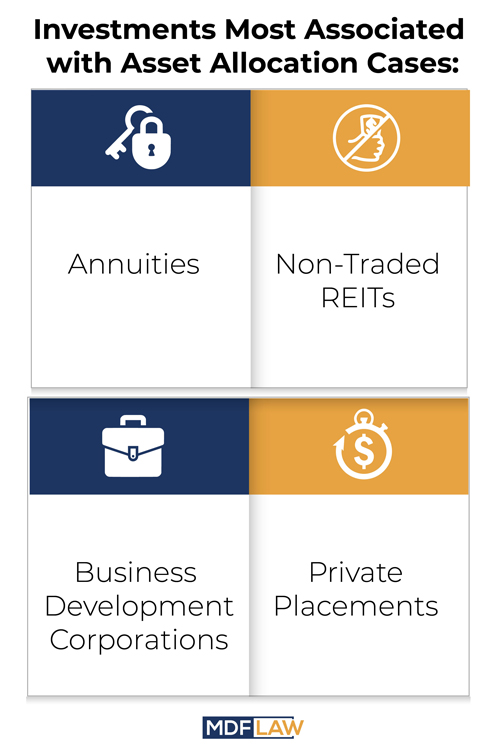

- Non-Traded REIT Cases: Unfortunately, many financial advisors market non-traded REITs, or real estate investment trusts, because of the lucrative commissions they are paid. Often clients are unaware of these commissions and are convinced to invest in non-traded REITs as an alternative to the stock market. In reality, non-traded REITs are much riskier than the stock market and are unsuitable for most retail investors.

- Fraud. These cases involve situations where an investor is told false information about an investment. They may also involve situations where important information is left out or omitted.

- Variable Annuity Disputes: These cases involve situations where an investor is misled or defrauded into purchasing an annuity. Like non-traded REITs, annuities are high commission products that are unsuitable for most investors. Variable annuities are highly complex investments that are governed by an insurance contract – making each one slightly unique depending on the client’s elections.

- Overconcentration Claims: These disputes involve allegations from customers that the financial advisor overconcentrated their accounts in one or a small number of assets. These cases involve the broker “putting the client’s eggs in one basket.” In our experience, overconcentration cases usually involve non-traded REITs, variable annuities or some other specialty product.

- Illegal or Unapproved Investments: These disputes involve situations where a financial advisor recommends an investment that is not approved for sale by his or her broker-dealer. Under the securities regulations, broker-dealers are legally required to monitor and prevent this type of conduct. As a result they are often liable for the actions of their sales people – even if they have no knowledge of the investments.

- Margin Disputes: There are two basic types of margin disputes. The first type concerns situations where a financial advisor places a client on margin without their knowledge or consent. The second type of case involves situations where a broker-dealer is negligent in effectuating an auto-liquidation of a client account.

Financial Advisor Negligence v. Fraud

Negligence is a breach of duty that’s accidental – a mistake. It’s not so different than the duty drivers have to people on the road, making taking your eye off the road negligent if it causes you to hit the car in front of you in the rear. A financial advisor’s duty is to “adhere to security industry standards” for their clients by avoiding mistakes such as:

- failing to put in a buy or sell order;

- Omitting to issue warnings about the risk of an investment;

- Failure to make suitable recommendations based on age, net worth, and other suitability information;

- Failure to undertake due diligence and understand the investments being marketed;

- Failing to follow industry rules or the rules of their brokerage firm;

- Any other mistake or error that may result in client account losses.

Clients can recoup losses due to financial negligence in an arbitration before the Financial Industry Regulatory Authority, or FINRA. Financial advisor fraud is intentionally deceptive behavior that can give rise to both civil liability and, in serious cases, criminal penalties. These are some examples of financial advisor fraud:

- Recommending investments solely to collect the highest fees possible;

- Recommending investments that are not approved by the advisor’s brokerage firm;

- Intentionally misleading clients about the fees or risks of an investment in order to collect higher commissions for themselves;

- Intentionally withholding adverse information about an investment in order to collect higher fees and commissions.

Sometimes financial advisors can continue these unethical and illegal actions for many years without being caught because their clients are not losing substantial amounts of money or don’t know how to take action against them to recoup their losses. If you’ve lost money because your financial advisor didn’t handle your account properly, call MDF Law PLLC for a free consultation to find out if you’re entitled to money damages for financial advisor negligence.

How Are Disputes With Financial Advisors Handled?

Most financial advisors are members of FINRA, so most disputes with financial advisors are handled through the FINRA arbitration process. The contract you have with your financial advisor will usually provide whether disputes will be handled through FINRA, the American Arbitration Association (AAA,) Judicial Arbitration and Mediation Services (JAMS,) or another type of arbitration. If there is no clause requiring arbitration, the matter can be arbitrated only if both you and your financial advisor agree to this forum and you have the option of starting a lawsuit in lieu of arbitration. If both parties agree, a non-binding mediation can sometimes resolve issues more quickly. If you’re planning to arbitrate, mediate, or litigate a dispute with a financial advisor, it’s important to hire a law firm to represent you that has a great deal of experience in this area. Call MDF Law PLLC for a free consultation to find out if you’re entitled to money damages due to a financial advisor’s negligence.