Tim Thelen Accused of Unsuitable GWG L Bond Recommendations

Tim Thelen (CRD# 1924966), a broker registered with American Trust Investment Services, allegedly committed elder abuse, according to a disclosure on his Financial Industry Regulatory Authority (FINRA) BrokerCheck report. This record, accessed on June 22, 2023, identifies Mr. Thelen as a registered representative in San Clemente, California.

Tim Thelen Recommended Unsuitable L Bonds

In February 2023 a customer lodged a dispute alleging a range of misconduct against Mr. Thelen. Specifically, the claim alleges that he gave misleading information about his investment recommendations, failed to conduct due diligence, breached contract, violated FINRA rules as well as securities law, and committed elder abuse. The underlying investments at issue in the dispute include GWG L Bonds, MRC Healthcare, a Pacini Hatfield Single Index Option Fund, US Energy, and more. The dispute, which remains pending, seeks damages of “an amount that exceeds $1,000,000.00”

What Is GWG Holdings?

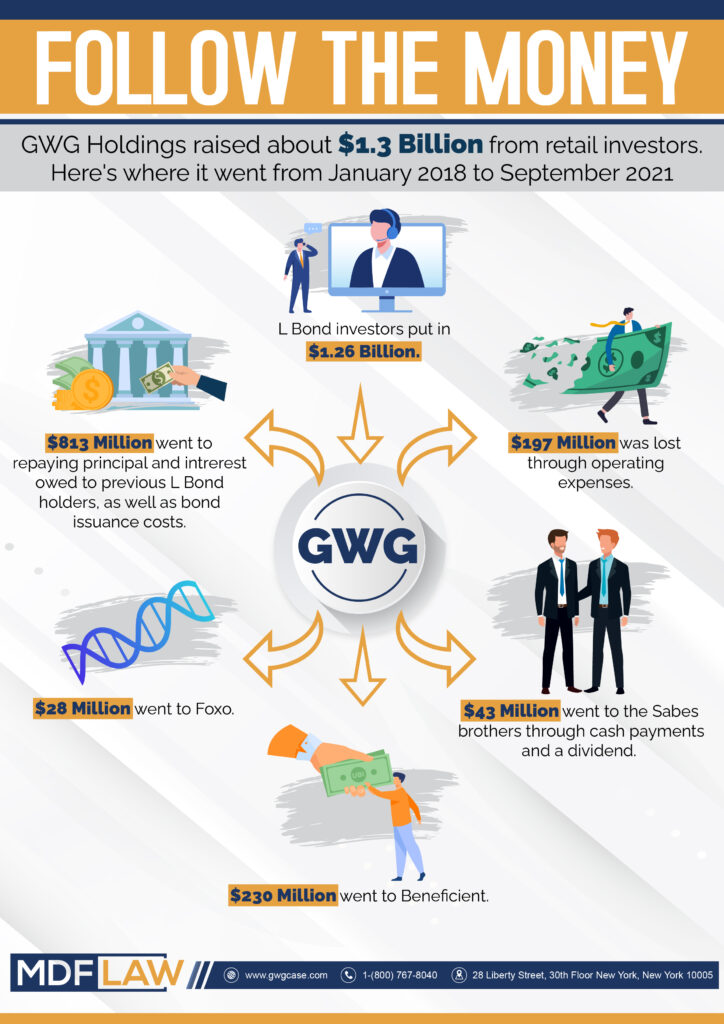

GWG Holdings filed for Chapter 11 bankruptcy on April 20, 2022. The company, whose L Bonds were risky and speculative investments, bad been under SEC investigation since at least October 2020, of which it informed investors in November 2021. Its principals used investors’ funds to make investments in their own ventures starting in 2018, of which they did not inform investors. If you lost money investing in GWG L Bonds, you may be able to file a FINRA arbitration claim against the company that marketed this investment to you. If you receive a recovery from that firm, you will still be eligible to receive any payments made as part of GWG’s bankruptcy proceedings.

For more information visit: www.GWGCase.com

Previous Complaints Settled for $192,500

Mr. Thelen has been involved in three investor disputes that resolved with settlements between the firms and claimants. Filed between 2006 and 2019, these disputes alleged breach of fiduciary duty, negligence, suitability violations, and failure to follow instructions. The investments at issue included variable annuities, private placements, and mutual funds. These disputes settled for a total of $192,500.

Understanding FINRA’s Suitability Rule

Under FINRA Rule 2111, brokers are required to weigh the investments they recommend in light of a customer’s investment background and objectives, including the risk levels they’re comfortable with and their sophistication as an investor. Investment advisers are required to uphold a fiduciary duty to their clients, recommending investments that are in the client’s best interests.

Background and Qualifications

Tim Thelen joined American Trust Investment Services’ office in San Clemente, California in May 2023. Prior to his employment at the firm, he was a broker at Aeon Capital’s office in Scottsdale, Arizona from 2018 until 2023, and at Accelerated Capital Group’s Scottsdale office from 2013 until 2018. He has passed the Series 63 exam and the Series 24 exam, among others.

Do you have complaints regarding investments recommended by Tim Thelen?

If your portfolio was not properly diversified, or if the risks associated with your investments were not adequately disclosed, you may have recovery options. Reach out to MDF Law for a free consultation regarding your case. Our team has extensive experience advocating for the victims of investment fraud, collecting millions in awards for our clients. To chat with an attorney for free, call 800-767-8040 today.