How to File a FINRA Complaint: A Guide For Burned Investor

by Admin Istrator | October 12, 2021 3:07 pm

If you feel you have been a victim of securities fraud, you can file a complaint at the Financial Industry Regulatory Authority, or FINRA[1]. To file a FINRA complaint, the financial adviser or broker must be registered with FINRA and most are. It’s also important to check your adviser’s history of misconduct using FINRA’s BrokerCheck service before commencing any relationship with them.

Repeated violations by FINRA members can result in expulsion from the industry, as was the case[2] with a licensed broker named Vladimir Oblonsky who was expelled from the industry in 2017 for failing to pay fines and now drives a cab in New York.

FINRA offers an official Complaints Program which investigates complaints. All FINRA complaints must be made via its Investor Complaint Center. These can be done electronically or via paper.

Before filing a FINRA complaint, FINRA recommends trying to resolve the issue with the firm or individual directly. Filing a FINRA complaint does not guarantee any payments to you, even if sanctions or suspensions are imposed on the adviser or broker. Filing a complaint with FINRA does not guarantee that it will be investigated. But, if it is investigated, brokerage firms and financial advisers are required to participate fully in FINRA’s investigation. FINRA cannot, however, subpoena individuals who are not part of the industry.

FINRA will require the complainant’s maximum cooperation to be able to carry out its investigation. Supporting evidence is crucial. They may also ask you to give a sworn statement or to testify at a disciplinary hearing. Confidentiality agreements between you and the brokerage or adviser are generally void when discussing the matter with FINRA staff.

Important: FINRA Complaints are not the Same as Arbitration or Mediation!

If you are seeking financial compensation for losses incurred, filing a complaint is not necessarily your best option.

A FINRA Complaint is primarily regulatory in nature. It exists to protect the interests of all investors. The result of their investigation usually leads to disciplinary action or sanctions against the broker or adviser involved. They do not usually lead to compensation for damages incurred.

Recently, Robinhood was ordered to pay[3] a record-setting $70 million fine as a result of a FINRA investigation. This fine will be used to compensate a large number of users who were wronged by Robinhood policies that FINRA found to be in violation of its code of conduct. This doesn’t always occur.

If you are seeking damages or compensation directly, filing a complaint with FINRA might preclude the option to arbitrate or litigate, and doesn’t guarantee that you will receive damages.

FINRA runs a sophisticated arbitration program with at least one hearing location in each of the US states, Puerto Rico, and the UK.

How to Begin a FINRA Arbitration Complaint

To request a FINRA arbitration, a claimant must file an arbitration claim, either online or through the mail.

An arbitration claim consists of:

A Statement of Claim. This statement, along with any supporting documents, lays out all the details of the claim, the parties involved, as well as the amount sought in damages[4]. It is essential to have an experienced securities fraud lawyer look over this statement before submitting it.

A Submission Agreement. This agreement assigns FINRA as the administrator of the claim and binds the parties to any decisions that FINRA makes in any subsequent hearing.

The claimant must pay the respective fees to file the arbitration claim. Arbitrators are pre-selected using computer-generated lists. The parties in the case will be shown a “disclosure report” for all arbitrators—this is a detailed report of that particular arbitrator’s history. Parties may then “rank and strike” a certain number of arbitrators from the list.

Much of the proceedings are carried out and accessible online via FINRA’s Dispute Resolution Portal.

Hiring a securities fraud attorney is highly recommended when requesting a FINRA arbitration.

What is the Difference Between FINRA Arbitration and Mediation?

Mediation is a lighter approach to dispute resolution which is voluntary for both parties. Whereas in arbitration, decisions are final and imposed, a mediator will only suggest a possible solution and cannot enforce it. Both parties can choose to switch to mediation during the arbitration process.

The primary benefit of mediation is its swiftness and relative inexpensiveness.

Both arbitration and mediation routes tend to be faster and less expensive than suing for fraud in the courts.

To begin a FINRA mediation, one or both parties must request one via FINRA’s “Initiate a Mediation” page. Mediation is entirely voluntary. All parties involved must agree completely to the mediator who will handle the case.

How to Select a Competent Securities Fraud Attorney

When going the arbitration route (and sometimes also the mediation route), a competent securities fraud attorney is imperative. If you already have a lawyer, ask them if they are able to take the case on. If your existing attorney does not feel confident they can handle a securities fraud case, they might be able to suggest someone who can.

FINRA recommends contacting various bar associations for a list of attorneys. We further recommend doing your own research. The attorney’s website and social media accounts are the obvious targets to start on, but also look for the attorney’s name in news reports. Have they won any large cases? Do they serve only investors or also institutions?

Fancy websites and catchy social media accounts are one thing. But the true test of a securities fraud attorney is their ability to win cases and bring in commensurate damages for victims of securities fraud. Just like in the US legal system, parties can forego an attorney and represent themselves. Unless the party is a trained attorney themselves, this is not recommended. If there is a hearing—all cases claiming damages of more than $50,000 require a hearing—then all parties will need to present their cases, and to question witnesses. This might be challenging for people without legal experience.

Contact Us to Evaluate Your FINRA Arbitration Claim

- Financial Industry Regulatory Authority, or FINRA: https://mdf-law.com/practice-groups/finra-arbitration/

- case: https://www.bloomberg.com/news/articles/2021-06-23/rich-russian-sued-rothschild-bank-in-new-york-claiming-fraud-over-oil-fortune

- ordered to pay: https://www.bloomberg.com/news/videos/2021-07-02/finra-s-eilleen-murray-on-robinhood-s-fine-regulation-video

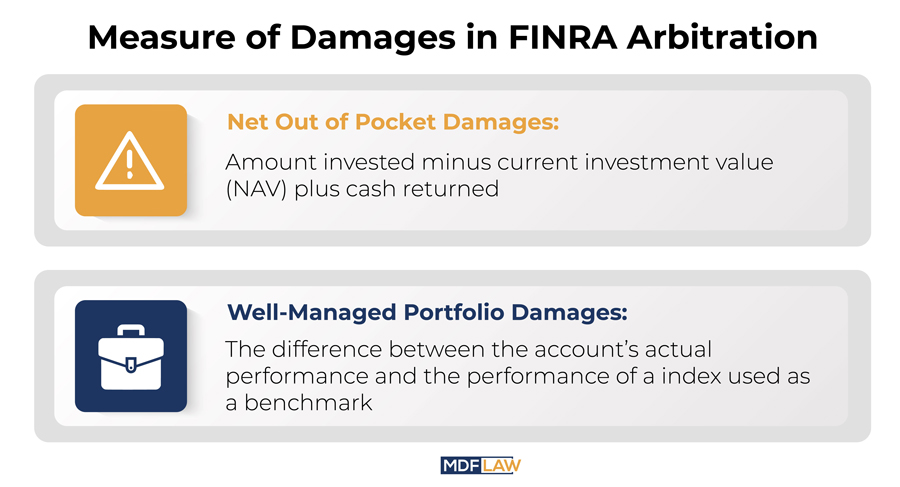

- amount sought in damages: https://mdf-law.com/civil-damages-for-securities-fraud-claims/

Source URL: https://mdf-law.com/how-to-file-a-finra-complaint/